irvine income tax rate

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. The US average is 46.

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Income and Salaries for Irvine - The average income of a Irvine resident is 43456 a year.

. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. A combined city and county sales tax rate of 175 on top of Californias 6 base makes Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. The County sales tax rate is.

Compare the best Income Tax lawyers near Irvine CA today. The 92618 Irvine California general sales tax rate is 775. Use our free directory to instantly connect with verified Income Tax attorneys.

Tax rates are provided by Avalara and updated monthly. - The Income Tax Rate for Irvine is 93. The combined Irvine sales tax is 775.

There is an additional 1 tax on taxable income over 1 million for mental health services. Get peer reviews and client ratings. The latest sales tax rate for Irvine CA.

- Tax Rates can have a big impact when Comparing Cost of Living. A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. Orange County sales tax.

The combined rate used in this calculator 775 is the result of the california state rate 6 the 92618. The Irvine sales tax rate is. The property tax rate is higher than the average property tax rate in California which is 073.

930 the total of all income taxes for an area including state county and local taxes. Did South Dakota v. This is the total of state county and city sales tax rates.

The average Manager State Income Tax salary in Irvine California is 101914 as of April 26 2022 but the salary range typically falls between 93078 and 112447. The average Income Tax Auditor salary in Irvine California is 69059 as of November 29 2021 but the salary range typically falls between 58266 and 81048. And its top marginal income tax rate of 123 is the highest state income tax rate in the country.

Find a local Irvine California Income Tax attorney near you. Look up 2022 sales tax rates for Irvine Florida and surrounding areas. Above 100 means more expensive.

100 US Average. This includes the following. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA.

The Sales Tax rate for Irvine California is 8. We have info about recent selling dates and prices property transfers and the top-rated tax rates near Irvine CA on our income tax rates directory. About our Cost of Living Index.

This represents 75 for California State taxes and 05 for Orange County. California state sales tax. Irvine Income Tax Rate.

Choose from 8 attorneys by reading reviews and considering peer ratings. Irvine Sales Tax Rate. The combined rate used in this calculator 775 is the result of the California state rate 6 the 92618s county rate 025 and in some case special rate 15.

Legislation requires that the vendor collects these funds for sales tax from the consumer at the point of sale. The California sales tax rate is currently. Sales Tax is a tax paid to a governing body on the sale of particular services and goods.

Below 100 means cheaper than the US average. Find the right Irvine Income Tax lawyer from 13 local law firms. - The Median household income of a Irvine resident is 91999 a year.

The us average is 46. Wayfair Inc affect California. Expect to pay between 1715 in rent for a studio or 3672 for a 4-bedroom.

The US average is 28555 a year. Everything from groceries gas prices. 2020 rates included for use while preparing your income tax deduction.

Taxes in Irvine California are 102 more expensive than Brea California. The US average is. The minimum combined 2022 sales tax rate for Irvine California is.

The state of Californias income tax rate is 1 to 123 the highest in the US. What is the sales tax rate in Irvine California. The average household income in Irvine CA is 91999 and a single resident has an average income of 43456.

The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. This rate includes any state county city and local sales taxes.

Pin By Tax Attorney Expert On Law Income Tax Preparation Tax Preparation Income Tax

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

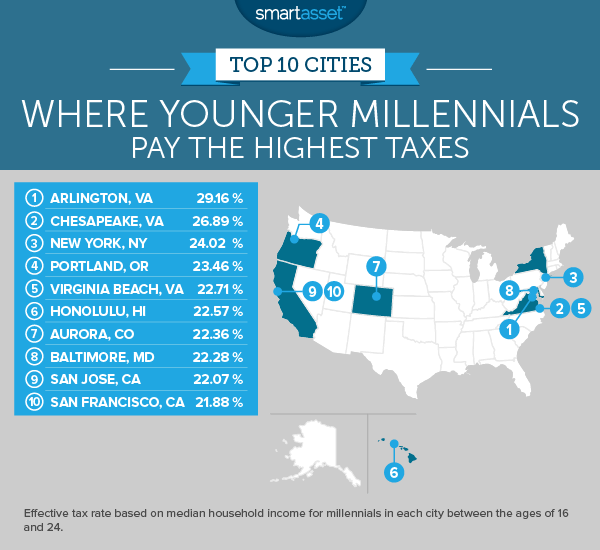

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Calif Business Owners Pay Highest Income Tax Rate Orange County Register

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

Create A P In Quickbooks Statement Template How To Memorize Things Profit And Loss Statement

Multiple Property Financing Commercial Loans Mortgage Companies Usda Loan

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

California Paycheck Calculator Smartasset

Why Households Need 300 000 To Live A Middle Class Lifestyle

Personal Income Tax Revenues As Percent Of Gdp And Of Total Revenues Download Table

Tips You Can Do To Save Money On Your Income Tax Fbc Tax Write Offs Home Based Business Investing

Non Prime Financing 500 Fico 1 Day Out Of Bankruptcy Foreclosure Or Short Sale Bank Statement Program Availab Commercial Loans Usda Loan Mortgage Companies

What Are California S Income Tax Brackets Rjs Law Tax Attorney

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

Ways To Save On Home Expenses Money Savvy Ways To Save Money Mindset

Why Households Need 300 000 To Live A Middle Class Lifestyle