nebraska sales tax rate 2020

Waste Reduction and Recycling Fee. FilePay Your Return.

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

536 rows Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2There are a total of 334 local tax jurisdictions across the state.

. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. The Nebraska state sales and use tax rate is 55 055. Find your Nebraska combined state.

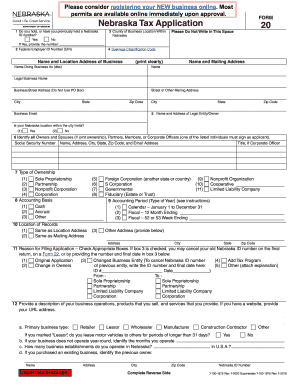

Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. Download Or Email NE form 20 More Fillable Forms Register and Subscribe Now. The minimum combined 2022 sales tax rate for Nebraska City Nebraska is.

Omaha Nebraska Sales Tax Rate 2020. Counties and cities can charge an. This is the total of state county and city sales tax rates.

What is the sales tax rate in Omaha Nebraska. This is the total of state county and city sales tax rates. Nebraska has recent rate changes Thu Jul 01 2021.

Notification to permitholders of changes in local sales and use tax rates effective october 1 2022 updated 06032022 effective. Average Local State Sales Tax. Maximum Local Sales Tax.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. Accurately file and remit the sales tax you collect in all jurisdictions. See the County Sales and Use Tax Rates section at the.

Nebraska State Sales Tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Ad Access Tax Forms.

What is the sales tax rate in Nebraska City Nebraska. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

Groceries are exempt from the Nebraska sales tax. Select the Nebraska city from the list of popular. Complete Edit or Print Tax Forms Instantly.

The base state sales tax rate in Nebraska is 55. Ad Automate the entire sales use tax process to increase tax compliance reduce audit risk. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Sales Tax Rate Finder. This is the total of state county and city sales tax rates. Changes in Local Sales and Use Tax Rates Effective April 1 2020.

Sales and Use Taxes. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825. The Nebraska NE state sales tax rate is currently 55.

See the County Sales and Use Tax Rates section. Nebraska sales tax details. What is the sales tax rate in Lincoln Nebraska.

Local Sales and Use Tax Rates Effective October 1 2020 Dakota County and Gage County each impose a tax rate of 05. While many other states allow counties and other localities to collect a local option sales tax. Maximum Possible Sales Tax.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Local Sales and Use Tax Rates Effective July 1 2020 Dakota County and Gage County each impose a tax rate of 05. Free Unlimited Searches Try Now.

With local taxes the total sales tax rate is between 5500 and 8000. Ad Get Nebraska Tax Rate By Zip. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Marginal Tax Rates For Pass Through Businesses By State Tax Foundation

Lowest And Highest Sales Tax States Claruspartners

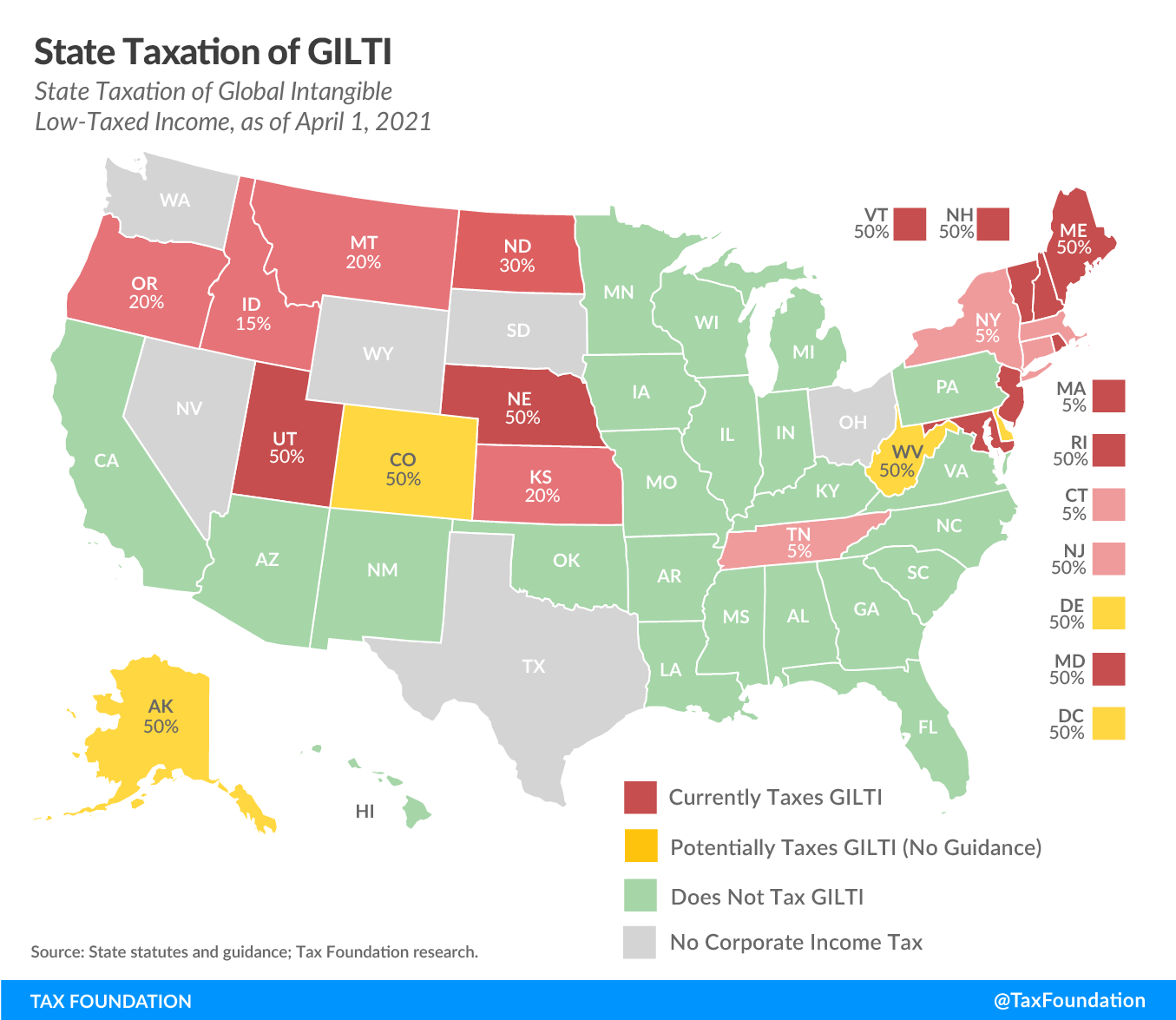

Nebraska Corporate Tax Bill Gilti And Corporate Rate Reduction

New Jersey Nj Tax Rate H R Block

Sales Tax Laws By State Ultimate Guide For Business Owners

State Sales Tax Rates 2022 Avalara

Taxes And Spending In Nebraska

Nebraska Sales Tax Rates By City County 2022

2020 Nebraska Property Tax Issues Agricultural Economics

State Sales Tax Rates Sales Tax Institute

2021 State Corporate Tax Rates And Brackets Tax Foundation

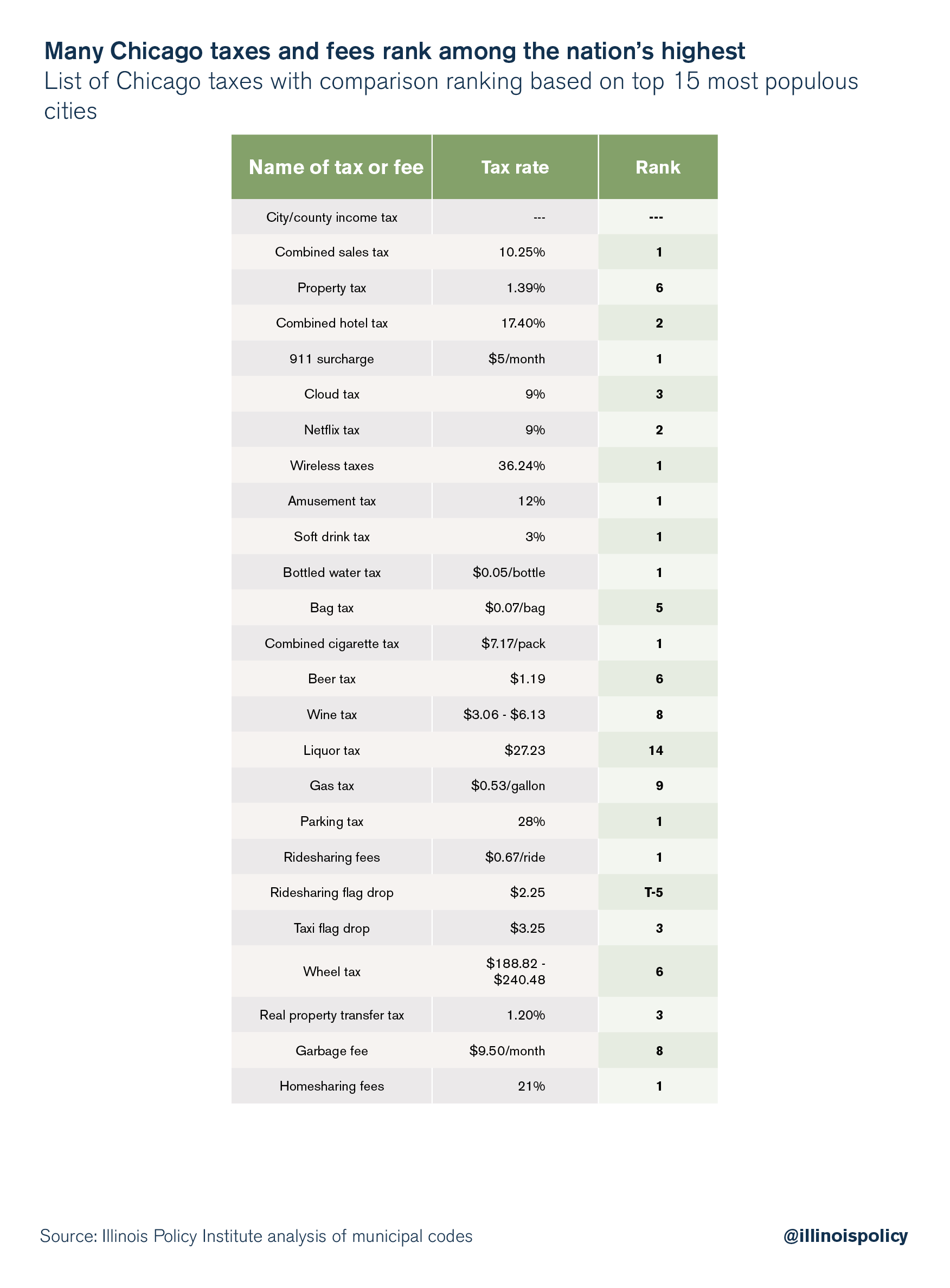

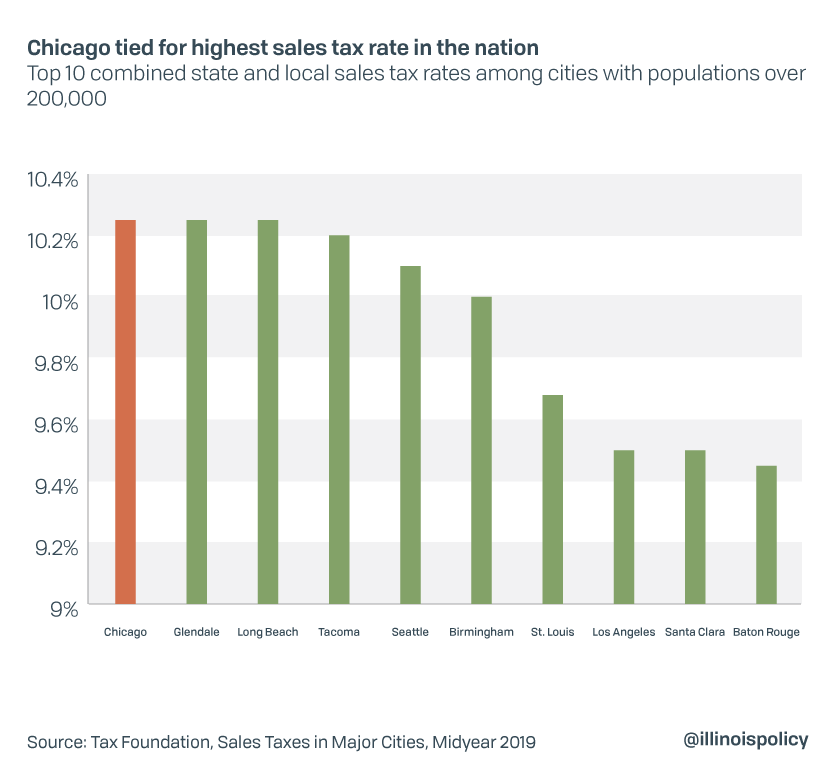

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Nebraska State Tax Tables 2022 Us Icalculator

Historical Nebraska Tax Policy Information Ballotpedia

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Tax Nebraska All Fill Out And Sign Printable Pdf Template Signnow